For any additional information please contact us directly:

Allgeier SE

Dr. Christopher Große

Montgelasstr. 14

D-81679 Munich

Tel.: +49 89 998421-0

Fax: +49 89 998421-11

E-Mail: ir@allgeier.com

For any additional information please contact us directly:

Allgeier SE

Dr. Christopher Große

Montgelasstr. 14

D-81679 Munich

Tel.: +49 89 998421-0

Fax: +49 89 998421-11

E-Mail: ir@allgeier.com

“The Nagarro group has outgrown Allgeier in recent years through its sustained organic growth and various acquisitions as an independent global tech services player. For Nagarro, it is important to be able to gain more attention and visibility with an independent listing and branding in the market, which we believe will also enable more attractive capital market valuations. With its own equity story, Nagarro will be positioned directly in the peer group of global software development and digital transformation companies.”

(Carl Georg Dürschmidt, CEO Allgeier SE)

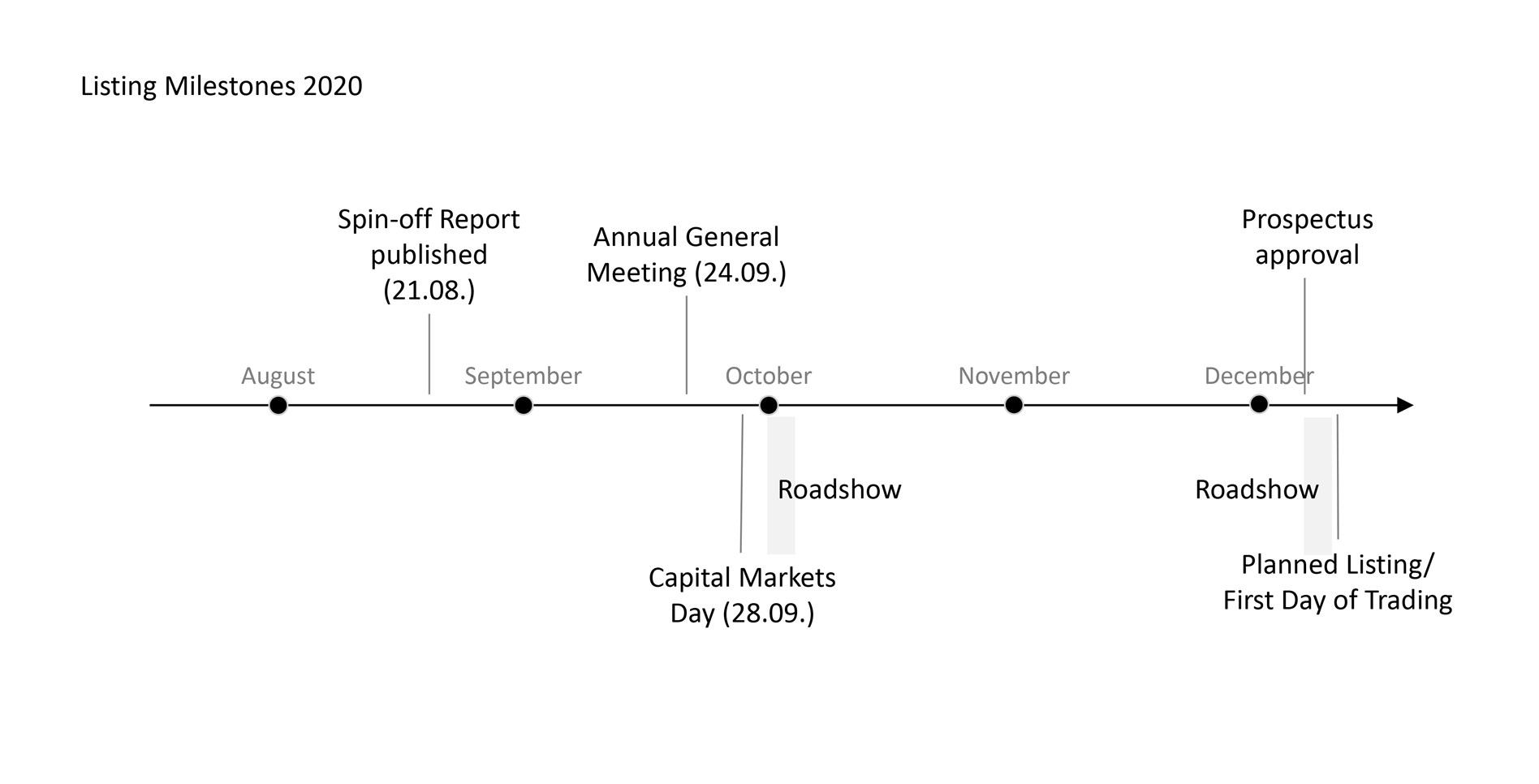

(Click on graphic to enlarge.)

Technical information of Allgeier SE for their shareholders on the implementation of the planned Spin-off of Nagarro SE

A proposal will be made to the Annual General Meeting of Allgeier SE on September 24, 2020 under agenda item 8 (Resolution on the Spin-off) to resolve on the Spin-off of Nagarro SE.

The following documents are published on the website of Allgeier SE Annual General Meeting:

The following information does not replace these documents. Rather, it answers possible additional questions from our shareholders in connection with the technical implementation of the Spin-off.